Why isn't France much richer than the UK?

, .

The Laffer Curve is one of my favourite concepts in economics. It says that at a tax rate of 0%, no tax is collected. This is obviously true. It says that at a tax rate of 100%, no tax is collected, which is probably close enough to true; why would you do taxed work if every proceed of that work was taken by the state? And then somewhere in between a maximum of tax is collected.

We don't know the shape of the Laffer curve. It is definitely different for different types of taxes, taxpayer, and activity. All these shapes change with time, location, with the tax regimes of neighbouring jurisditions, and much more. Estimating the Laffer curve is difficult and has many uncertainties, especially the time parts since it is with time that the largest effects of higher and lower tax rates on tax revenue emerge if higher and lower tax rates affect the growth rate of the economy and thus the taxable base.

My favourite feature of the Laffer curve concept is how powerful it is at figuring out who not to listen to about economics. Economists who think that the Laffer curve always justifies tax cuts are not worth listening to. Economists who play up the complexity I mentioned in the last paragraph to dismiss the Laffer curve as a concept are not worth listening to. Which leaves us with reasonable people with engaged brains.

The Laffer curve, France, and the UK.

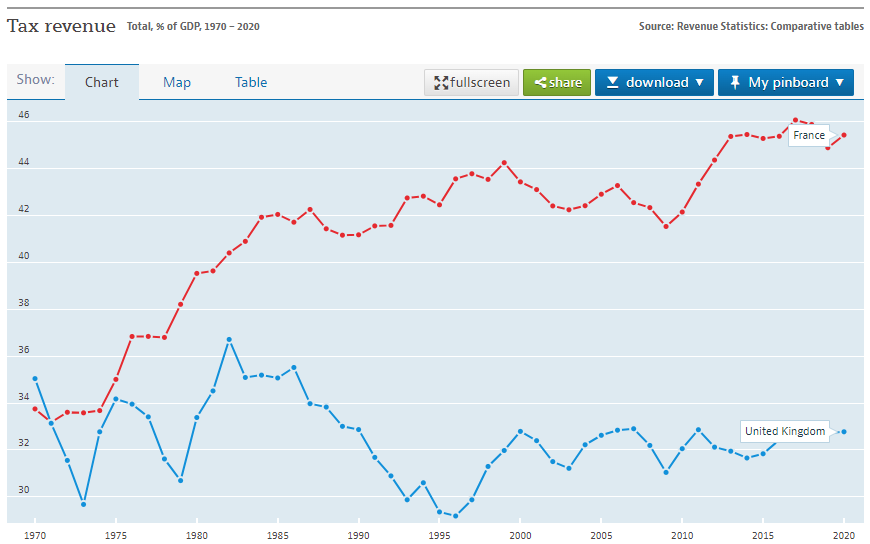

In 1970, France charged the same level of taxes as the UK. Today, fifty years later, French taxes are far higher.

At the same time, France's economy has grown at exactly the same rate as the UK's. This means that tax revenues have grown proportionally to the tax rate.

We could use this finding to argue that the Laffer curve for a whole country for a tax rate between 30% and 46% of GDP still has a positive gradient and that the revenue-optimising tax rate is above 46%. Many French economists do. But I'm less convinced.

My feeling, and with such a complex system a feeling that's regularly checked against data is as good as you're ever going to get, is that the current French tax rate is close to the revenue-raising maximum in the short term and slightly above it in the long term.

So to grow the UK economy, I'd raise taxes a lot. To grow the French economy, I might reduce them slightly.

But there's one big thing that makes me question myself. If raising taxes (and more importantly the accompanying spending) is good for growth, why aren't the French much richer than us?

The highly-taxed French are only slightly better off than much lower-taxed Brits.

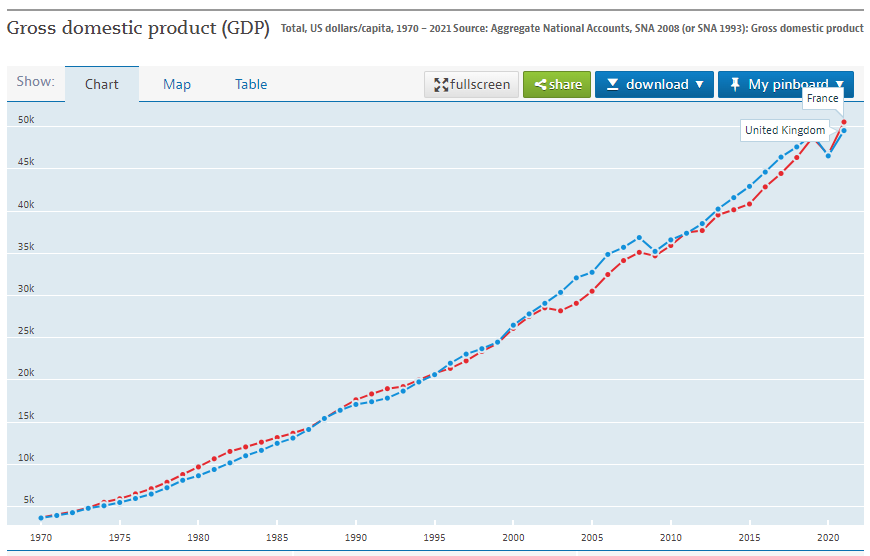

The extent to which most French are better off than most Britons is hard to measure. My preferred measure for comparing the prosperity of countries is GDP per person and French GDP per person is only slightly higher than in the UK. It's within the measurement uncertainty.

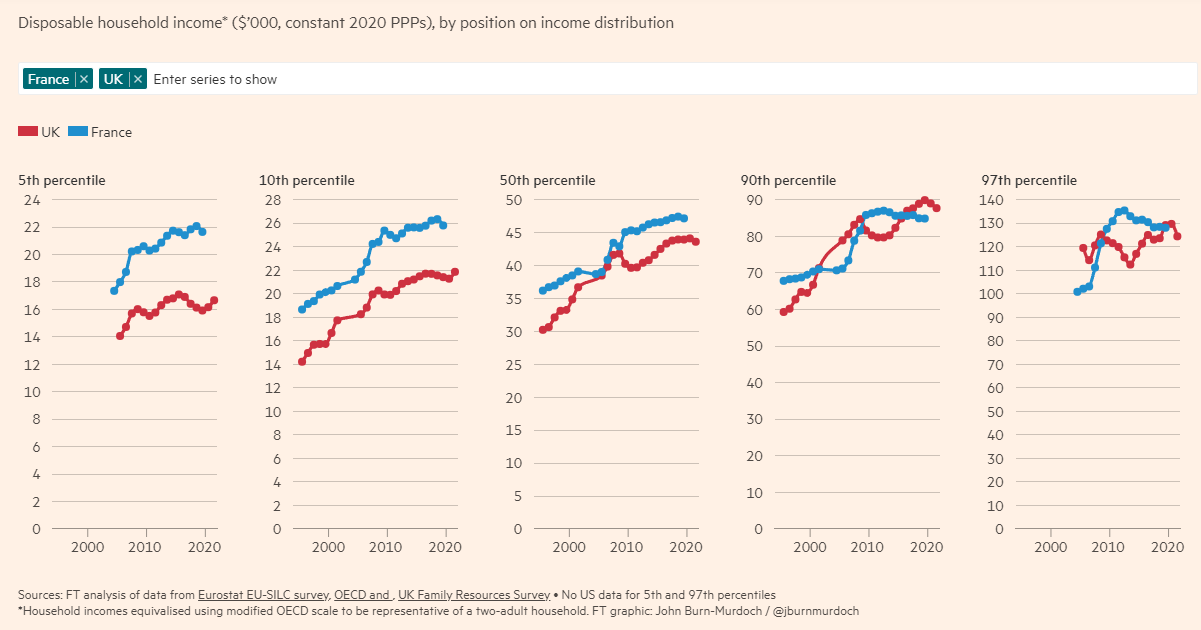

Estimates of household income in the FT showing that the vast majority of the French population has a higher income than their equivalent in the UK feel overly pessimistic about the UK to me. I suspect a problem with currency conversions.

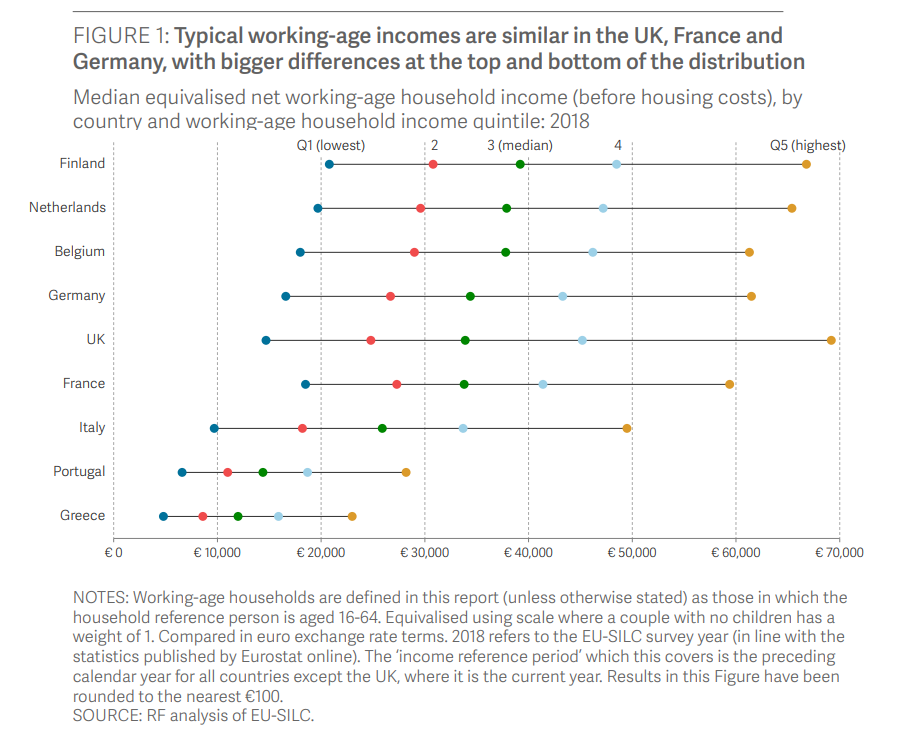

Similar analysis by the Resolution Foundation feels closer to right to me. The median income in France is the same as in the UK. The poorer half of households are better off in France and the richer half of households are better off in Britain.

Why aren't the French richer?

So why aren't the French much richer? The useless answer is that economic comparisons are so complex that we have no way of knowing. A more interesting answer is that I think it's partly because France chooses to remain rural.

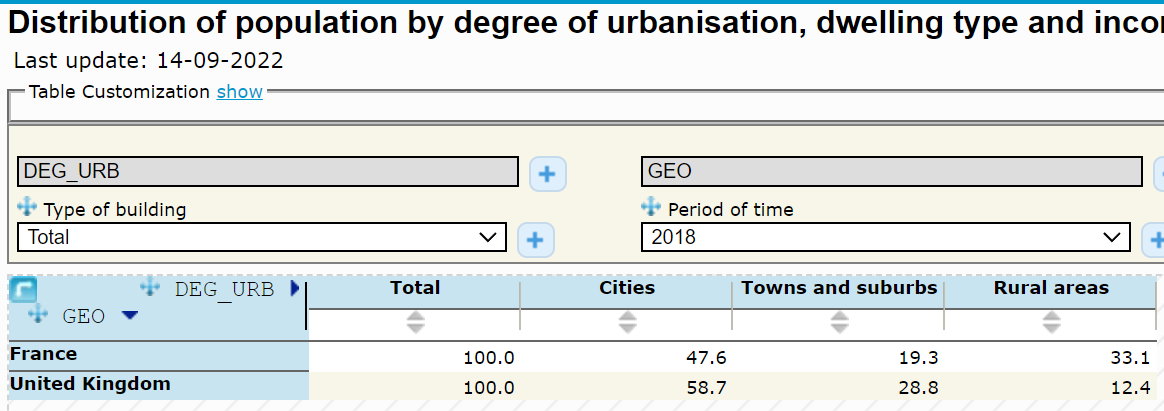

Nearly a third of the French population lives in a rural area compared to just over a tenth of the UK population.

Despite efforts such as the creation of protected origin wine and food to boost the value of French agricultural produce these rurals areas remain economically weak. Only generous transfers keep incomes reasonably high in rural France.

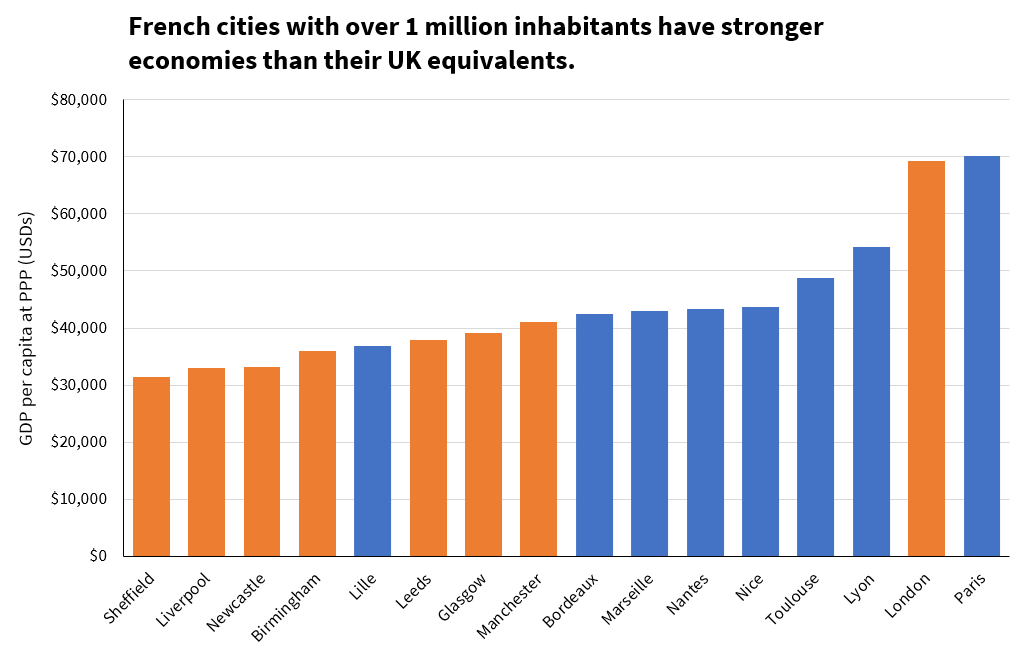

In French urban areas, high taxes pay for high investment that generate strong economic growth. France's large cities have better infrastructure, higher public investment, and have much stronger economies than their British equivalents.

The increased economic growth of high French taxes is largely used to preserve a large rural population for cultural reasons. I think this explains much of why France, despite having higher tax rates that I think should lead to a stronger economy, does not significantly outperform the UK as a whole.

If the UK raised its taxes to the level of France, including adopting similar tax devolutions that make taxes in cities higher than outside them, I suspect that we would end up with a 10% to 15% stronger economy than France given our far smaller rural population. For the moment we're choosing not to.